Market Review Q1 2024 | Market Review Q2 2024 | Market Review Q3 2024

Fourth Quarter 2024

The People Have Spoken

2024 will likely go down in the history books as a consequential year on many fronts. The focal point was a contentious presidential election resulting in the election of Donald Trump to serve a second term, unleashing a new trajectory for economic policy and potential transformation of the Federal Government with the establishment of the new Department of Government Efficiency (DOGE) led by Elon Musk and Vivek Ramaswamy. Many other topics captured our attention during the year, including evolving Federal Reserve policy, the stratospheric rise of the “Magnificent Seven,” AI, the advent of Bitcoin ETFs, continued global conflict and mysterious drones. In sum, the divergent themes of this year were extremes and uncertainty, coupled with buoyant economic growth, positive equity market performance for a second consecutive year and the return of the bond vigilantes.

“It’s the economy, stupid,” a phrase coined 32 years ago during the Clinton versus Bush election in 1992, resurfaced in this election cycle as Americans voiced their dissatisfaction with the impact of three years of high inflation on their lives. The nomination of Donald Trump to head the Republican ticket was in many respects more surprising than his win in the general election. Democrats were in a weak position due to the cumulative impact of high inflation on almost all goods and services, reducing consumer confidence, which hit a low of 66.4 in July. Social issues and immigration concerns also swayed the electorate in a resounding fashion. In the end, Democrats failed to convince enough voters that they would fare better sticking with the same playbook.

The U.S. Economy is the Envy of the World

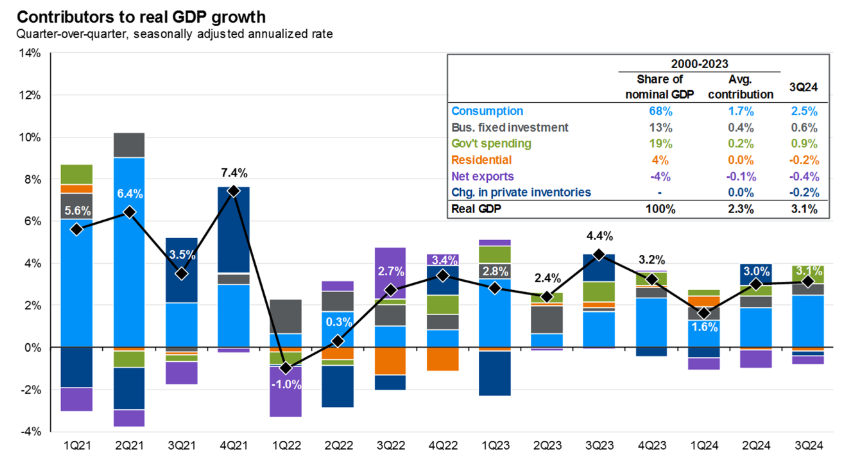

Although many Americans felt betrayed by the U.S. economy, from a global perspective the U.S. continues to be envied. GDP posted a solid 3.1% increase in the third quarter, revised upward from the initial 2.8% estimate. This followed a 3.0% increase in the second quarter and a modest 1.6% increase rise in the first quarter. Strength in the third quarter was attributed to a robust uptick in consumer spending, with a 5.6% increase on goods purchases and a 2.8% increase on services spending, while fixed investment was boosted by a 10.8% increase in equipment. Detractors included a larger than anticipated drop in structure investments and a decrease in residential construction. Fourth quarter GDP is expected to come in at about 2.1% according to current estimates by the conference board survey of 1000 economists and the current GDP NOW estimate is about 2.7%.

Source: BEA, FactSet, J.P. Morgan Asset Management, 12-31-2024

With the consumer driving the economy, the strength of the jobs market has been the fuel to keep folks comfortable spending. Nonfarm payrolls increased by a whopping 227,000 in November after posting a measly 36,000 increase in October due to the impact of multiple extreme weather events. December followed suit with another massive increase in nonfarm payrolls of 256,000, far exceeding the expected increase of 150,000. While the unemployment rate ticked down slightly in December to 4.1% from the November level of 4.2%. This level of unemployment is within the bounds of what the Federal Reserve considers normal to achieve maximum sustainable employment. Average hourly earnings increased 4.0% year-over-year in both October and November, marking the 20th straight month of wage gains that exceeded the inflation rate. These factors added to consumer confidence, which came in at 74 in December and has steadily increased since the July low.

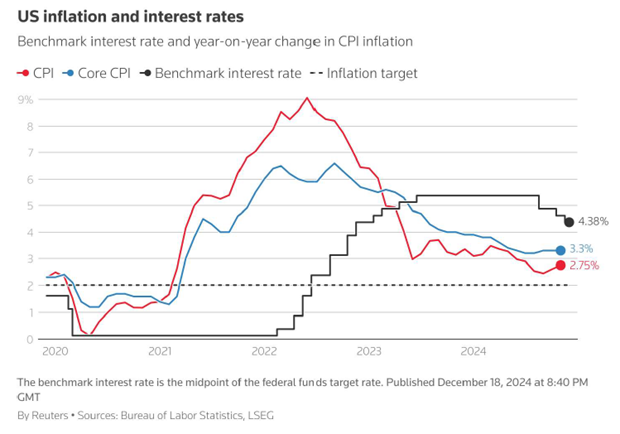

After dropping to 2.4% in September, the rate of inflation as measured by the Consumer Price Index ticked up in the fourth quarter to 2.7% in November. Despite the uptick, there was much progress in 2024, considering that the annualized rate of inflation was as high as 3.5% in March. The reading for December is expected to be noticeably lower at 2.3%. Core inflation, which excludes food and energy, has proven to be stickier, with the November reading at 3.3%. A slight decrease in the cost of shelter was present, however shelter costs and auto insurance rates continue to hamper the efforts to move the inflation rate closer to 2.0%. Going forward, the path of inflation is less clear since some of the policy proposals from the new administration, such as tariffs, are considered inflationary.

Federal Reserve Policy - On Hold?

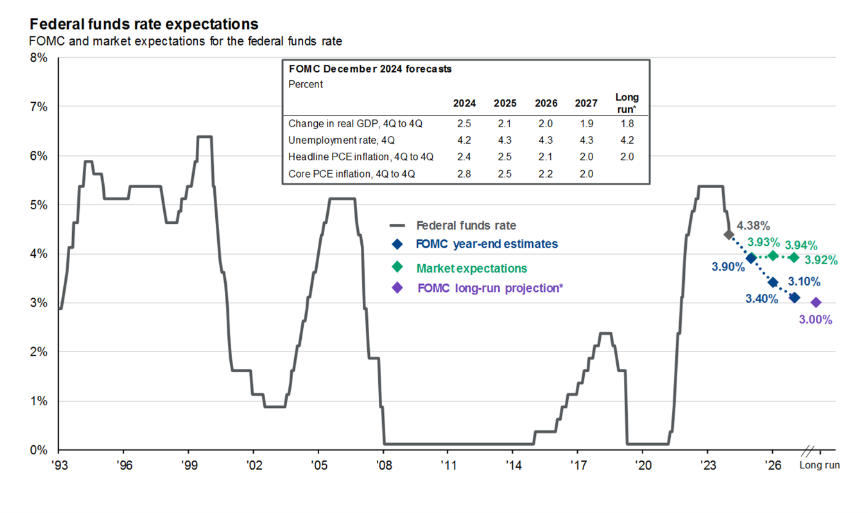

Going into the fourth quarter, bond markets reflected the expectation that the Federal Reserve would maintain its cycle of cutting rates after the initial 50 basis point reduction in September. Indeed, the Fed followed through and reduced the federal funds rate by 25 basis points at both the November and December meetings, leaving the fed funds rate in a range of 4.25%-4.50% at the end of the year. However, the outlook of the FOMC at the December meeting showed a slight shift in both the choice of words in its statement and the dot plot, which is a graphical depiction of where each member anticipates the federal funds rate to be in each of the next 3 years. While the Fed noted that risks to meeting its dual goals of promoting maximum employment and price stability were roughly in balance, Chair Jerome Powell stated, "It's a new phase and we're going to be cautious about further cuts." The December dot plot showed a reduction in the amount of rate cuts expected by the committee from 100 basis points (in the September dot plot) to just 50 basis point of cuts in 2025. The chart below depicts the new FOMC estimates in blue and the market expectations in green. The outlook for FOMC policy by the market was upended during the quarter, with the expectation now that the Fed will only enact one 25 basis point cut in 2025, and none thereafter.

Source: Bloomberg, FactSet, Federal Reserve, J.P. Morgan Asset Management

The Bond Vigilantes Are Back

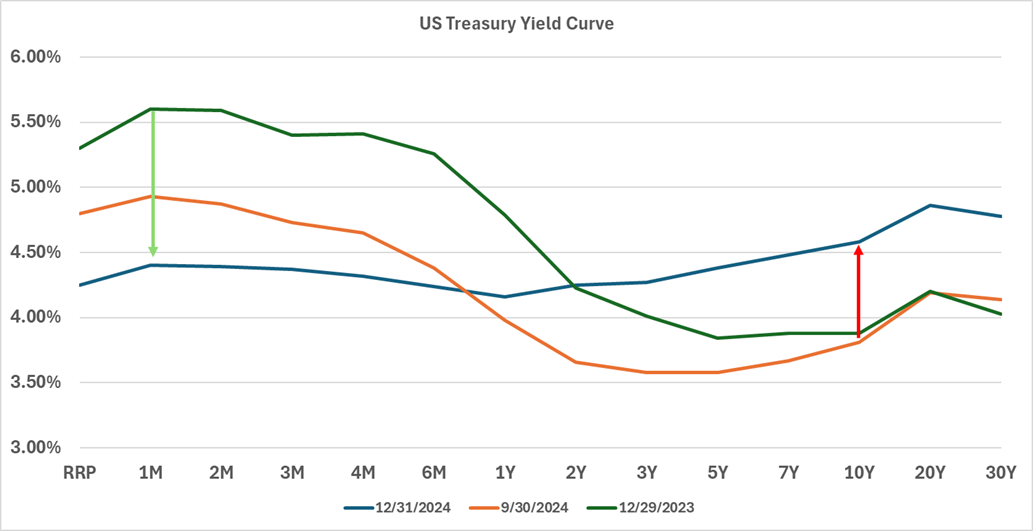

The bond market, usually a calm harbor when seas are rough, is continuing to experience choppy waters. After two years of an inverted yield curve, where short-term rates were higher than longer-term rates, the yield curve is now upwardly sloped. However, the way the curve shifted this year proves the point that the Fed only controls the very short end of the fixed income markets and market forces dictate the rest of the curve. In the chart below, the lines indicate the U.S. Treasury yield curve at the beginning of 2024, the beginning of the fourth quarter and the end of 2024. What is notable is the extreme shift in the curve with short rates coming down, but longer rates moving higher. On the short end, rates moved significantly lower due to Fed policy as indicated with the green arrow. Longer term rates, on the other hand, initially moved mostly lower during the year as economic data improved the longer-term outlook for inflation. However, during the last quarter, rates from one to 30 years moved considerably higher as that outlook faded. The U.S. 10-year Treasury yield moved higher by about 77 basis points in the fourth quarter, ending the year at 4.58%, signaling market anticipation for potentially higher inflation and growth.

Source: www.ustreasuryyieldcurve.com

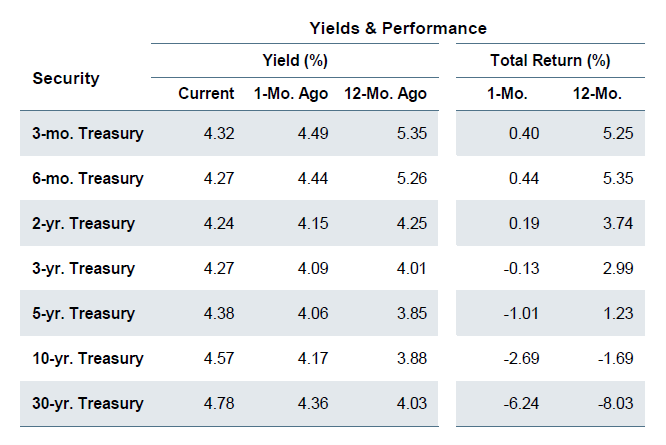

This volatility in rates proved tiresome for fixed income investors who are conflicted by appreciating the higher yields bonds offer while also feeling downright crummy about market values decreasing. Overall, the fixed income market eked out a positive return for the year with the Barclay’s Aggregate Bond Index posting a total return of 1.25% for 2024, paling in comparison to the 3-month Treasury total return of 5.25%.

Source: Eaton Vance, The Beat January 2025, FactSet, Morningstar as of 12/31/24

The (Tech) Bulls Maintain Their Run

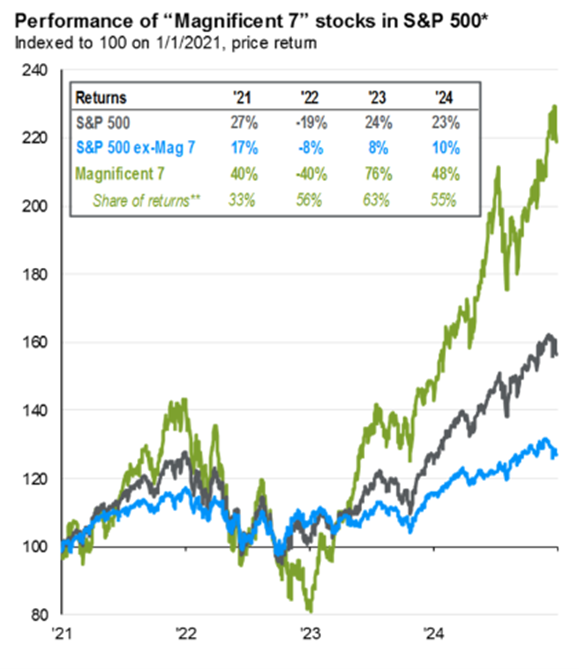

Market performance in 2024 surprised to the upside for a second consecutive year, posting back-to-back returns over 20%. Like 2023, the equity markets were driven by growth of the Magnificent Seven stocks. Looking at the chart below, the bulk of the S&P’s 23% return in 2024 was due to the 48% return of the Magnificent Seven, with the remaining 493 stocks returning 10%. In the fourth quarter, as the election neared, market volatility increased along with investor angst - a common occurrence in a presidential election year. With the Trump win, markets were initially propelled by the anticipation of a pro-growth, low tax policy agenda. By the end of the fourth quarter, reality started to set in that some of these policies may be inflationary or could reduce the work force, taking some steam out of the rally.

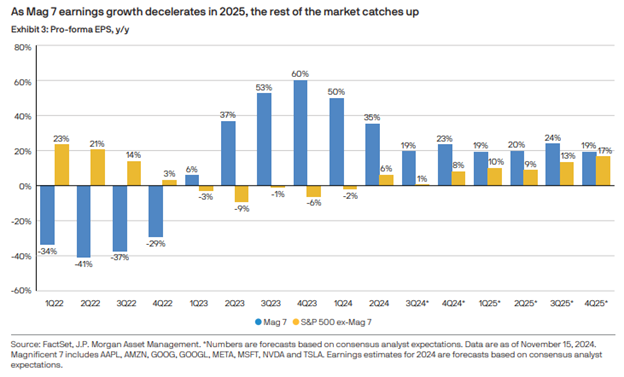

Third quarter corporate earnings were again led by the Magnificent Seven, which showed a 19% year-over-year increase in earnings, with the remaining S&P 500 constituents showing only a 1% year-over-year earnings growth, as seen in the chart below. Going forward, most estimates show this dichotomy shifting as tech company growth slows from its elevated levels to companies in other sectors exhibiting better earnings potential, as depicted in the chart below from mid-November. Factors such as improvement in productivity, a more stable supply chain and balanced labor supply contribute to the improving outlook. Estimates for Q4 earnings of the S&P 500 constituents, according to FactSet, is 11.9% year-over-year which would be the highest increase in the last four years.

Looking Forward - DOGE, Tariffs, Jobs

The new administration brings the possibility for significant policy change that could have a long range and wide impact on the economy. If President-elect Trump follows through on his campaign promises, the impact on the economy and financial markets is yet to be determined due to the conflicting nature of various goals. At a high level, the policy changes we are monitoring are tariffs, taxes, deregulation and Fed independence, as these could have the biggest impact on the economy and markets. Several of the proposed policy changes may not mesh. For example, if immigration is reduced and workers are sent to their home country, an already-tight labor supply will be reduced, which is both anti-growth and will potentially hinder bringing companies back to the U.S. Another policy conundrum is the tariff proposals. The tariffs have been touted as a way to pay for the proposed extension of the current tax regime, which is currently set to end at the end of 2025, and as a source of revenue for additional tax breaks. On the other hand, tariffs have also been explained as a bargaining chip, not meant to be enacted as proposed, which then infers that utilizing the tariffs to offset the cost of tax reductions will not happen. Lastly, the national debt is ballooning to levels that eventually could become unsustainable, making this another important area of policy to monitor. While the policy proposals we may see changing in 2025 will be met with mixed reviews, one policy proposal most people will cheer is the end of daylight savings time. This proposed legislation from Marco Rubio last March, the My Sunshine Protection Act, should be easier to get through Congress and will likely please both sides of the aisle.

Conclusion

Will 2025 bring fair winds and flowing seas, or are there storm clouds on the horizon? At least in the short run, we anticipate elevated market volatility as the new administration settles in and its policy objectives either gain traction or face resistance. Now, more than ever, diversification is key to navigating a foggy macro environment. We encourage our clients to focus on their goals and long-term objectives, knowing that we are diligently monitoring the markets and your investments. As we head into the new year fortified by hopefulness, we leave you with this quote from Jimmy Carter:

“To be true to ourselves, we must be true to others.” — Inaugural Address, 1977.

Nancy Taylor, CFA, CAIA®

Senior Investment Officer

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, CFA, Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.