Market Review Q1 2023 | Market Review Q2 2023 | Market Review Q3 2023 | Market Review Q4 2023 | Market Review Q1 2024

Second Quarter 2024

Mid-Year Report Card - Taking Stock

Key take-away: At mid-year, the macro backdrop remains supportive with slowing not stalling economic growth, a cooling not collapsing labor market and inflation measures moderating. Accelerating earnings and broadening earnings growth is a constructive landscape for markets as we march ahead into what is seasonally a more volatile time of year.

Economy - Soft Landing Intact

Approaching the second half of the year, economic growth remained near its long-term trend of 2% but not without challenges, as growth continued to normalize after its torrent pace in 2023. It will be key to assess whether the economy is simply slowing or if it appears to be stalling. Focusing on Q1 final sales to domestic purchasers as opposed to GDP, which excludes more volatile trade and inventories, we are still above trend at 3.1%. Looking ahead, the Atlanta Fed GDPNow Q2 forecast continues to trend lower, a direct result of weaker consumption trends.

As we move into the second half of the year, we look to the consumer for clues if significant downside is ahead. With stockpiled savings dwindling and financing rates high, the average consumer’s ability and willingness to spend seems inextricably tied to the health of the labor market. Currently, the labor market is healthy and supportive of continued spending with wage gains outpacing inflation for the past year and job creation still averaging over 200,000 for the last three months.

Moving ahead, we remain focused on high frequency data that could signal a turning tide in the labor market from the normalization of supply and demand to outright job destruction. Initial jobless claims and the JOLTS (job opening labor turnover survey) data will be key to watch to see if a drop in labor openings and job creation leads to a rise in unemployment. Keep in mind that historically, we’ve seen job creation right up to the start of a recession with swift and significant job losses punctuating the start of a recession.

Inflation - Disinflation Returns

May’s inflation prints, whether we look at CPI (Consumer Price Index), PPI (Producer Price Index) or the Fed’s preferred PCE (Personal Consumption Expenditures), all point to the return of a deflationary trend. A welcome sign after several months of hot inflation data called into question the future path of rates. As we move ahead, markets will focus on month-over-month readings to confirm a sustained move lower. A reading of 0.2% or lower in monthly PCE would support the current path.

It is helpful to look beyond the headline numbers and focus on the “sticky” elements of inflation. Supercore inflation, which looks at service inflation excluding housing, fell to a six-month low in May. This is good news and important to watch because this number integrates insurance costs in its reading, a large contributor to this year’s inflation figures. We also watch OER, or owners’ equivalent rent, the largest component in CPI. It has been stubborn and slow to reflect the rent deceleration we are observing in real-time. Further progress on these two fronts will cement the disinflationary story.

Monetary Policy - Rate Cut Timetable Pushed Out

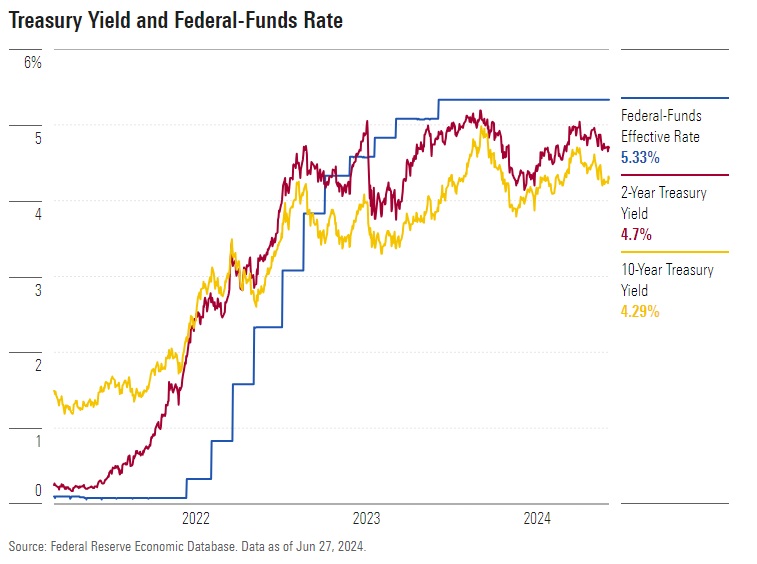

At the June Fed meeting, no rate cut was expected, and one did not occur. A string of stronger economic data and reaccelerating inflation pushed back the rate cut timetable. The dot-plot and summary of economic projections reflected their concern. A mere single rate cut is now projected in 2024, while the series of cuts anticipated this year have been pushed to 2025. Also of interest was the recognition that the Fed’s rate cutting cycle will result in a higher terminal rate than earlier anticipated — a nod to the fact that long-term structural inflationary pressures will remain in the economy for a while.

While the Fed remains steadfast in needing a string of disinflationary data to initiate a rate cut, Fed officials have reasserted a more balanced concern of late, refocusing on the impact to economic growth and employment in their quest to tame inflation. Fed member Mary Daly’s comments acknowledged the daily weight of inflation and the severe long-term damage of unemployment on a family’s finances. Ms. Daly’s comments suggest the Fed is cognizant of their dual mandate of low inflation and full employment as opposed to solely focusing on inflation.

With further rate hikes off the table, a focus on why the Fed cuts will be of greater concern than when they cut. The message to the market will be vastly different if the first cut is the result of tame inflationary trends that result in modulating restrictive policy as opposed to cuts precipitated by rising unemployment or material economic weakness from higher rates for too long causing “something to break.”

Markets – Concentration & Complacency

After an all-inclusive first quarter rally, Q2 gains were narrowly concentrated in the tech-laden Nasdaq and tech-heavy S&P 500. After taking a leg lower in April, the S&P 500 powered higher in May and June on the back of strong earnings and subsiding inflation, closing near all-time highs. The index is now up 14.5% year to date and up 52.6% from its October 2022 low.

On the surface, markets moved higher with little incident. Volatility at the index level, as measured by the VIX, was subdued. Dissecting the index by sector and at the individual constituent level tells a different story. Correlations amongst individual stocks dropped to record low levels. At the sector level, tech and tech-adjacent communication services enjoyed outsized gains while cyclical and defensive sectors languished this quarter.

The S&P gained 4.3% in the second quarter with many sectors significantly lagging the index level return. Six out of eleven sectors posted negative quarterly returns, leaving Technology +13.8% and Communication Services +9.4% to pull the index higher.

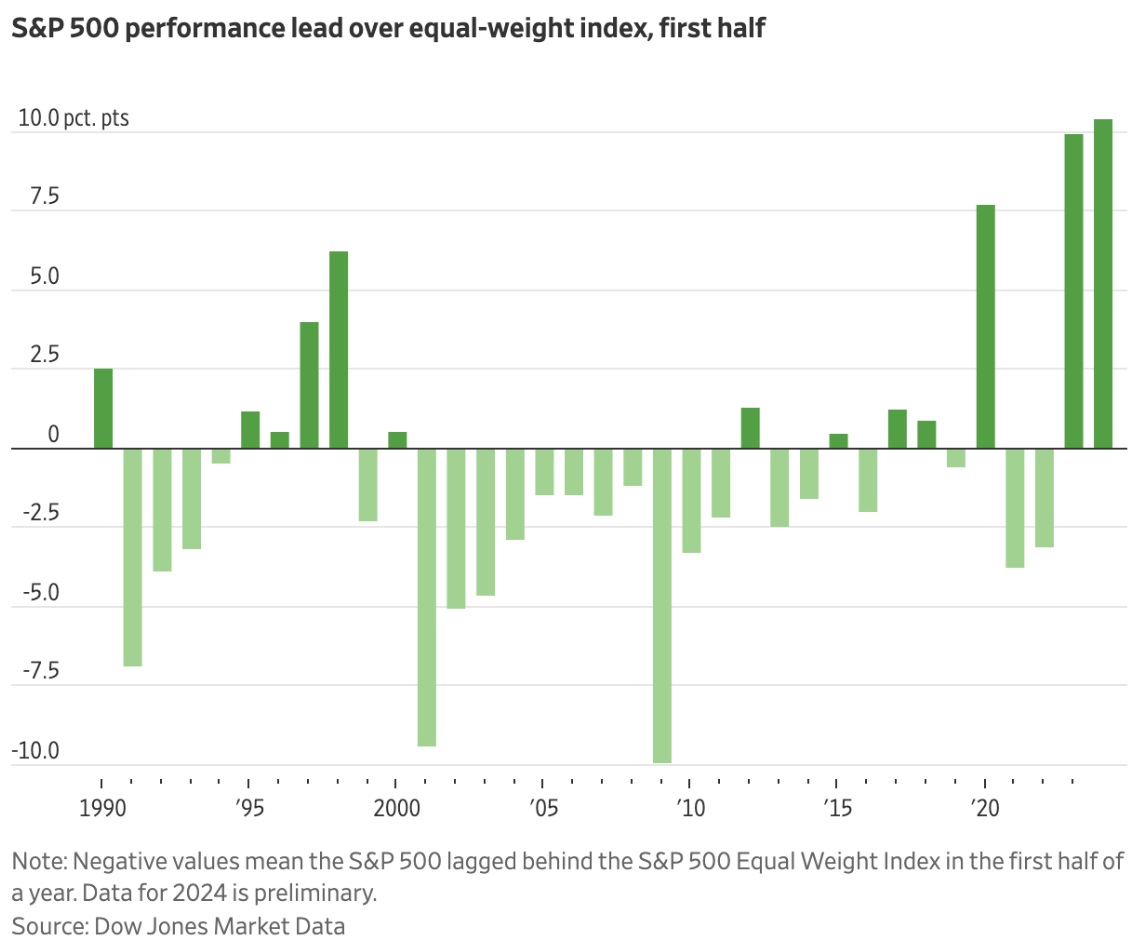

Market concentration has been deemed “a feature not a bug” by many market strategists, but the return differential between an equal-weighted index and a market-cap-weighted S&P 500 index is nearing an extreme. According to Dow Jones Market Data, the equal-weighted index is up just 4% so far this year, underperforming the S&P 500 by 11% — the biggest gap in the first half of a year going back to 1990.

Concentration concerns continue as you drill deeper into individual stock performance. Market excitement for all things Artificial Intelligence (AI) propelled a select set of mega-cap tech stocks higher, namely the “Magnificent 7,” whose outsized impact on market returns intensified in the second quarter. With dispersion amongst the cohort resulting in NVDA, AAPL, GOOG – just 3 names – accounting for 4.3% of the S&P 500 return or 109% of the index’s 3.9% second quarter return1.

Earnings and AI euphoria pushed Nvidia shares 37% higher this quarter, making it the S&P 500’s top performer. In June, market leader Nvidia leapfrogged both Apple and Microsoft to become the world’s most valuable company with a market capitalization exceeding $3 trillion. Keep in mind it was only last June 13 that it breached $1TR market cap, and March 1 of this year it reached $2TR – thereby gaining $2TR in value in 358 days!2

Monetization of AI continued to be a key theme for companies in the quarter. Markets richly rewarded companies that provided proof of AI’s transformative impact on productivity and profitability. Apple was a prime example. Apple’s stock price had languished for much of the year with investors left to contemplate how Apple would invest, adopt and monetize AI. In June, AAPL provided a window into its adoption of AI with the introduction of APPLE INTELLIGENCE and investors reacted by pushing shares higher by 10% in a week.

Fixed Income - Volatility Remains

Bond markets experienced heightened volatility in the second quarter as market participants reacted to every growth and inflation data point. What ensued was a quarter-long tug of war in rates across the Treasury curve. And while the 2-year and 10-year tenors moved significantly during the quarter, both ended close to where they stood on March 31. The 2-year Treasury, captive to Fed policy expectations, rose over the quarter with stronger data peaking near 5% in April only to settle back to 4.7% by the end of June (as of March 31, it was at 4.72%) as reflationary fears subsided and odds of a September rate cut rose. 10-year Treasury notes, with a sensitivity to economic, inflation, and supply data peaked at 4.66% before moving lower, closing the quarter at 4.29% (4.33% as of March 31).

Today, bond investors are enjoying decade high "all in yields" that should help insulate their returns in the near term if interest volatility continues in the second half of 2024. And we expect, as inflation normalizes and rate cuts begin, the ballast of bonds in a 60/40 portfolio should return.

Earnings - Broadening participation

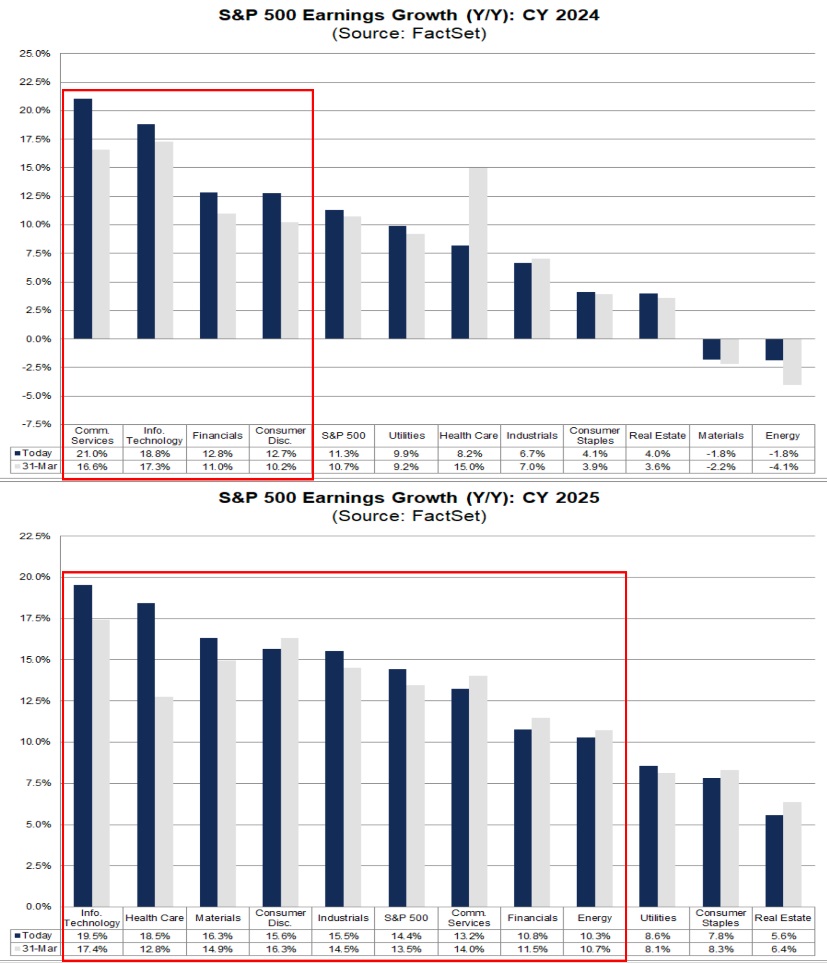

Q1 earning growth came in stronger than anticipated with S&P 500 companies reporting 5.8% EPS (earnings per share) growth as compared to 3.4% estimates. Much of the strength in earnings growth can be credited to the technology sector. Moving ahead it will be important to watch for broader participation at the earnings level from market constituents.

According to FactSet, FY24 EPS growth estimates are 11.3% while FY25 EPS growth is expected to be 14.4%, providing a favorable market backdrop. Furthermore, FactSet's Earnings Insight points out an anticipated broadening of earnings in the back half of FY24 and continuing into FY25 with eight of the 11 S&P 500 sectors expecting double digit earnings growth as opposed to only four in 2024.

In the second quarter, a well-diversified portfolio experienced outsized gains from stocks over bonds. Growth stocks outperformed value stocks. Large-cap companies beat small-cap and U.S. stocks bested international developed stocks. Emerging markets were an exception outpacing even the S&P 500.

Additionally, precious metals posted impressive gains. Gold logged its third straight quarterly gain, rising 4.5% for Q2 on debt, deficits and geopolitics concerns, while silver's industrial demand refocused investor attention on this other shiny metal.

Recent narrow leadership and concentrated gains this quarter remind us of the key role of rebalancing and diversification when managing a portfolio, providing both defense by reducing risk and offense by incorporating investments poised to protect and benefit as market cycles change.

While optimistic, we acknowledge that the second half of the year is ripe for the return of volatility as geopolitical and election headwinds move from the background to the foreground in the coming months. In addition, with each passing month of higher-for-longer rates, market participants become more and more wary that the economy's resilience could break upending our economic exceptionalism and by extension corporate fundamentals. Finally, S&P 500 valuations are stretched presenting a headwind to further index upside.

As we head into the summer months, wistfully called the "lazy hazy" days of summer, we recognize that markets, the economy and politics will be action packed. As your trusted advisor, we at Cape Cod 5 will remain vigilant, monitoring each data point, assessing its potential impact on your investments and proactively managing your portfolio to provide you with peace of mind this summer.

As always, we encourage you to reach out to your wealth management team with any questions along the way.

Wishing you a happy, "lazy and hazy" and thoroughly enjoyable summer.

Rachel Aiken, CFP®

Senior Investment Officer

On behalf of the Cape Cod 5 Trust and Asset Management Investment Team

Michael S. Kiceluk, CFA, Chief Investment Officer

Brad C. Francis, CFA, Director of Research

Rachael Aiken, CFP®, Senior Investment Officer

Jonathan J. Kelly, CFP®, CPA, Senior Investment Officer

Nancy Taylor, CFA, CAIA®, Senior Investment Officer

Robert D. Umbro, Senior Investment Officer

Benjamin M. Wigren, Senior Investment Officer

Kimberly K. Williams, Senior Wealth Management Officer

Craig J. Oliveira, Investment Officer

Jack Dailey, Investment Analyst

Alecia N. Wright, Investment Analyst

1 Data Trek - Q2 Year to Date Performance Review - June 30, 2024

2 Yahoo! Finance Morning Brief - June 20, 2024

These facts and opinions are provided by the Cape Cod 5 Trust and Asset Management Department. The information presented has been compiled from sources believed to be reliable and accurate, but we do not warrant its accuracy or completeness and will not be liable for any loss or damage caused by reliance thereon. Investments are NOT A DEPOSIT, NOT FDIC INSURED, NOT INSURED BY ANY FEDERAL GOVERNMENT AGENCY, NOT GUARANTEED BY THE FINANCIAL INSTITUTION AND MAY GO DOWN IN VALUE.