Sole Proprietorship

Most recent two years of filed federal tax returns

LLC or LLP

Most recent two years of filed federal tax returns including K-1, if applicable

Personal information for all owners with 20% or more ownership (including SSN and image of a driver’s license OR other government-issued ID)

Executed operating agreement

C Corp or S Corp

Most recent two years of filed federal tax returns including K-1, if applicable

Personal information for all owners with 20% or more ownership (including SSN and image of a driver’s license OR other government-issued ID)

Certificate of organization OR articles of incorporation

Am I eligible to apply online?

All for-profit businesses or self-employed individuals established in Massachusetts and operating within Cape Cod 5's service area are eligible to apply for a loan to be used for business purposes. You must provide your last two years' tax returns.

If you are a nonprofit organization, or a business that has never filed a tax return, please reach out to us about our loan options through this form.

Who is NOT eligible to apply online?

Businesses who have never filed a tax return.

Nonprofit organizations.

Associations.

Start-up businesses.

Businesses seeking a loan for a real estate transaction.

If you meet one of the above criteria, reach out to us through this form to find out more about how we can assist with your financing needs.

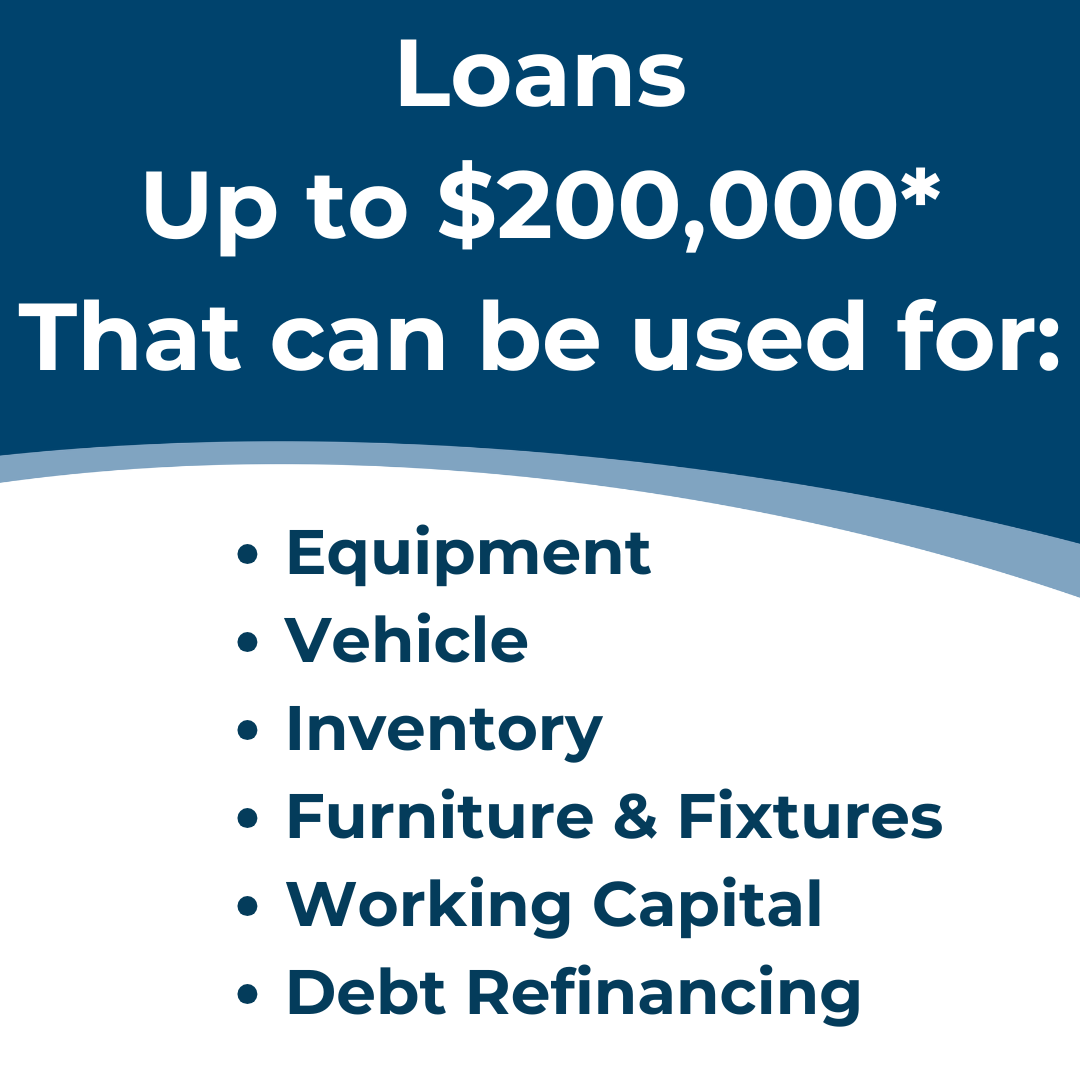

What is the maximum amount that I may request for a loan through this online application?

You may apply online through the loan portal if you are requesting a minimum of $5,000 and up to $200,000 for a term loan for:

Equipment

Vehicle

Inventory

Furniture & Fixtures

Working Capital

Debt Refinancing

If you would like to apply for a loan greater than these amounts, please reach out to us through this form.

Will I need to open a Cape Cod 5 business checking account?

Yes, we require a Cape Cod 5 business checking account. If you do not already have one, this can be opened as part of the closing process.

What documents will I need to provide?

Sole Proprietorships |

|

LLC or LLP |

|

C Corp or S Corp |

|

How long does the process take?

Most applicants will be able to close on their loan within two weeks.

Funding to your Cape Cod 5 business checking account will occur within one business day of the closing date.