With Cape Cod 5’s merchant services, you have the technology and the team to help power your business.

Click here for technical support information

Payment solutions that make running your business even easier

Cape Cod 5 offers options to meet your needs, while enabling your business to accept the methods of payment that your customers expect at point-of-sale (POS) or online. Paired with our broad array of business banking services, managing your day-to-day finances has just gotten simpler!

Cape Cod 5 offers options to meet your needs, while enabling your business to accept the methods of payment that your customers expect at point-of-sale (POS) or online. Paired with our broad array of business banking services, managing your day-to-day finances has just gotten simpler!

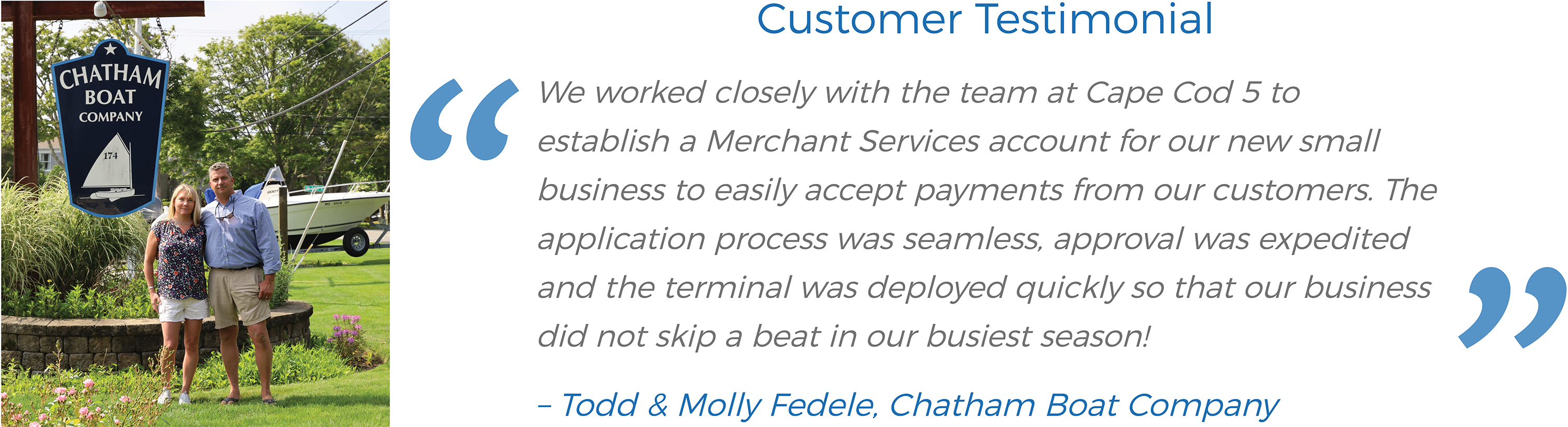

A trusted and experienced team on your side

Find seamless payment solutions with full PCI compliance that are backed by a local team committed to your success, and who can offer guidance in a changing payments landscape. We ensure fast and effective implementation with a customized schedule so that you don’t miss a beat.

Find seamless payment solutions with full PCI compliance that are backed by a local team committed to your success, and who can offer guidance in a changing payments landscape. We ensure fast and effective implementation with a customized schedule so that you don’t miss a beat.

Reach out to us to find out how we can assist you with payment solutions to support your business, including:

-

Point-of-sale (POS) systems, including tipped transaction support, on-screen signatures and email receipts

-

Product management tools

-

eCommerce & online ordering

-

Fraud monitoring and chargeback assistance

-

Business to Business (B2B) solutions & customer invoicing

-

Level 3 processing

-

API development & software integrations

-

eCheck services

-

Achieving full PCI compliance

-

Tools and reporting to help you manage your business

-

And more!

Cape Cod 5’s Merchant Services is powered by Chesapeake Payment Systems

Meet Our Team

Meet Our Team

Mary Beth Eddy

Mary Beth Eddy

Director of Merchant Services

Email Mary Beth

Mary Beth has over 35 years of experience in the payments space, with extensive knowledge and expertise in all facets of merchant solutions. Mary Beth joined Cape Cod 5 in 2023 in the role of Vice President, Director of Merchant Services.

Previously, Mary Beth held leadership roles at a large retail and commercial bank, payment processors, a local independent software vendor ISV and a payment Fintech. She attended the University of Massachusetts, Lowell and is a longtime member of the Cape Cod community.

Mary Beth brings creativity to everything she does and enjoys both home and interior design.